CRYPTOCURRENCY | Financial Planning & Analysis and People Planning

OUR CLIENT

A cryptocurrencyplatform, that provides more than 10 million customers, across 40 markets, with a safe, easy-to-explore app to buy and store cryptocurrency.

BUSINESS CHALLENGES

The business adopted Anaplan to improve the efficiency, accuracy, and speed of Financial Planning and Analysis. Before Anaplan, Central Finance had collected data from entities and countries in spreadsheets, and preparing key financial reports was time-consuming and prone to error. The complexity of their business meant that managing all the data in spreadsheet models was a business risk and difficult to manage. A single source of data was needed to underpin FP&A processes and to ensure the reliability of financial reporting.

People costs are a large proportion of the business cost and the P&L needed to include more up-to-date people costs and forecasts. They also needed better control of their people planning and recruitment processes.

When the business engaged Profit& the business had already implemented Anaplan for Financial Planning and Analysis, however, the dimensionality in their model wasn’t optimised to manage the scale of their business requirements. Sparsity in the model meant that processing times were excessive and only one person understood the model and could explain how the numbers were calculated.

The business had not achieved all the benefits of Anaplan. Profit& was engaged to rebuild the application to deliver all of the expected benefits and return on investment. The new model needed to be fully understood to reverse the ‘black box’ effect that had been created.

SOLUTION

Profit& broke the project down into two phases, so that our team could re-educate business users and build confidence in the solution once more. Phase one focused on re-designing the FP&A Model to deliver P&L, Revenue, and Operational Expense Reporting. Inefficiencies in the model were eliminated by nesting hierarchies so that combinations that don’t have data are eliminated and sparsity reduced. New dashboards enable users to drill down and clearly see how the numbers had been generated, creating transparency and trust.

New functionality was introduced for Revenue Planning that had continued to be completed in spreadsheets. This disconnected part of the process and associated data were standardised onto the Anaplan platform, delivering a single source of data, and further improvement to process speed and data accuracy.

The business can now project plans forward 5 years easily in Anaplan. They simply create new versions for the current year, next year's forecast, plus a further 3 years. Adjustments to assumptions are made to show the effect of variables and forecasts such as growth rate and inflation for example.

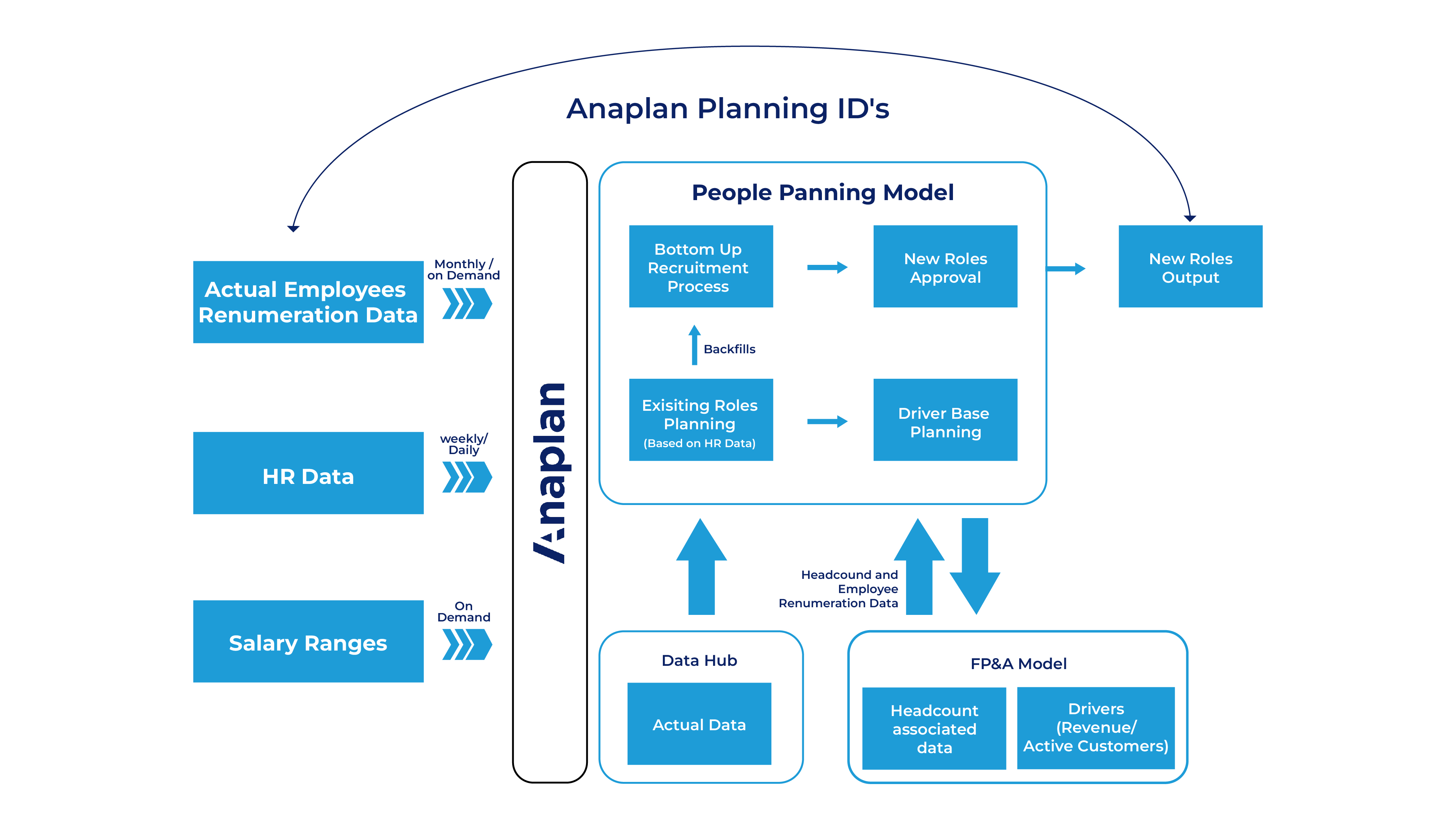

Phase two focused on rebuilding the People Planning model. Some formula had been hard coded and wasn’t fully understood. These were re-developed to reduce formula size by 95% and ensure they are fully understood. Data is transferred into the new People Planning model. This included actual remuneration data from the general ledger, people in post records, including new hires from the HR Operations system, and salary ranges provided by the Reward Team. The People Planning model enables HR to plan and execute the recruitment process for new and replacement roles, as well as plan for the movement of people within the business. Workflow is inbuilt to control the approval process by the Reward, People Analytics, and Remuneration Committee.

Data is connected to the FP&A model so that the latest people costs are reflected accurately in the latest P&L.

Data Flow Between Anaplan and Source Systems

BENEFITS

Anaplan is no longer considered to be a ‘black box’ as it now provides full transparency of how calculated figures are generated. Business users understand results and are benefiting from the solution both locally and centrally. Key person dependency is no longer an issue and processing speed has dramatically improved because of reduced sparsity and a much smaller FP&A model. Luno is now experiencing enthusiastic user adoption and confidence in the solution.

Finance no longer spends time gathering data from business entities across this global organisation. Entities and regions simply submit their forecasts directly into Anaplan on a rolling basis, and HR data is updated directly from the People Planning Model. A snapshot is taken on a quarterly basis for reporting, and analytics is available for decision-making when it is needed.

Long-range planning provides investors with a view of return on investment over time, helping to create certainty and confidence.

People Planning processes are more efficient too. HR has a clear view of people plans, and workflow manages processes efficiently. Everyone knows what part they have to play to ensure the smooth execution of people changes. Data flows efficiently between HR Operations and Recruitment systems maintaining data integrity and security at each stage of the process. Connecting directly to the FP&A Model ensures that the P&L reflects the very latest people costs.

The Client Team was highly involved in model development and is able to maintain and further develop their applications. In the short term, they plan to build cash flow and balance sheet reports so that all key financial reports flow from Anaplan.

“Profit& expertise was invaluable to create a system with an efficient design that brings together all the data we need for timely, accurate financial reporting that supports performance management. In re-directing our efforts in Finance from data gathering and checking for errors, to helping the business interpret the numbers and make performance improvements has been transformative for our business. We are now taking decisions with greater confidence and certainty about the outcome.”

Chief Finance Officer

“We have much greater control over our recruitment processes and have confidence that policies set by the Reward, People Analytics, and Remuneration Committee are adhered to rigorously and people change is managed efficiently so that our business can function as it should”

HR Director

Profit& to firma konsultingowa specjalizująca się w przekształcaniu złożonych problemów biznesowych w innowacyjne rozwiązania do planowania i zarządzania.

.

Anaplan jest liderem w zintegrowanym planowaniu. Ich oprogramowanie zbudowane na opatentowanym silniku Hyperblock, umożliwia planowanie w sposób dynamiczny, inteligentny i oparty na współpracy. Jako Silver Tier Partner, jesteśmy doświadczonym zespołem i możemy zaoferować klientom spójną, niezawodną jakość usług wdrożeniowych w Anaplan.

Kontakt

Email: info@profitand.com

Profit& Sp. z o.o

Ul. Złota 59

Skylight p. 14

00-120 Warsaw

Poland

Telephone: +44 7818 568970

Profit& Ltd

100 Bishopsgate

London

EC2N 4AG

United Kingdom

Telephone: +44 (0)208 1382241

Profit& GmbH

Neuer Wall 75

20354 Hamburg

Germany

Telephone: +49 40 22859120

Profit& Srl

Via Savoia 78

00198 Rome

Italy

Telephone: +39 0685237413