What is FP&A process transformation?

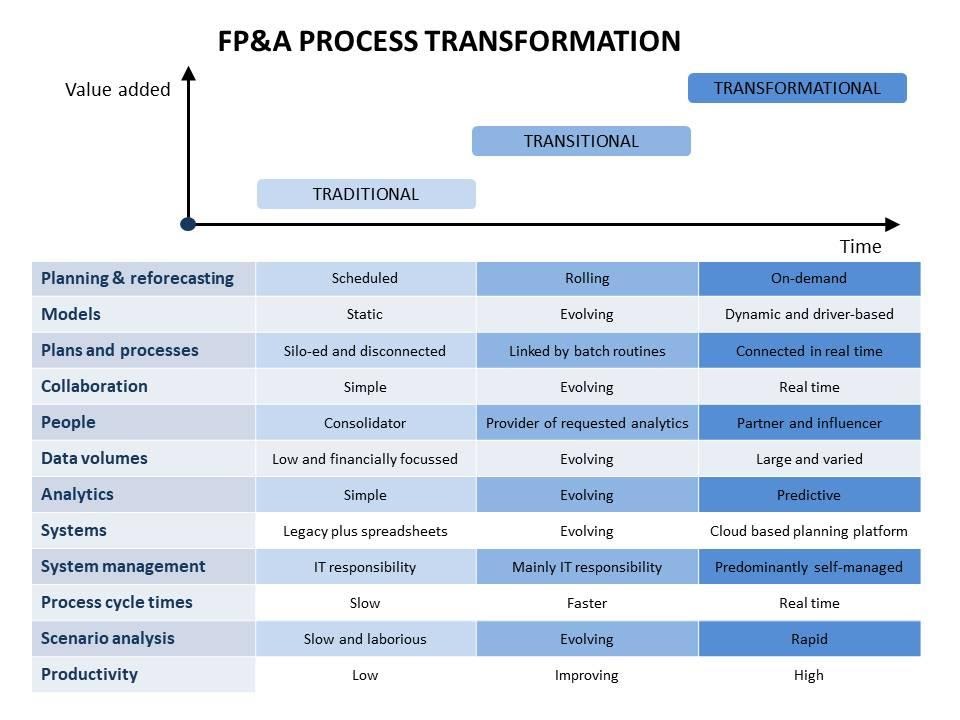

Transforming the finance function, so it can become a better business partner focused on value-adding activities that actually help the organisation achieve its strategic and financial goals, has been talked about for quite some time. Now, with the advent of new digital technologies, it’s finally a reality that CFOs and their finance teams can implement and immediately benefit from. What’s more, the transformation is incremental rather than disruptive, and supporting new processes with new generation, cloud-based solutions means implementations are swift without the need for large, upfront capital investments. That way you can quickly benefit, by first addressing your immediate pains points, before moving on to other processes.

At the core of that transformation are financial planning and analysis (FP&A) activities, such as business planning, business unit strategy, investment allocation and predictive analytics that become increasingly important as finance shifts its emphasis from backward looking reporting to helping the business deliver an above-par performance in an increasingly uncertain future.

Rest assured there is no one-size-fits-all FP&A operating model, as companies and industries all have distinctive needs, as they are at very different levels of maturity, complexity and growth. However, you do need to articulate what your FP&A processes will look like in the future, what your key focus areas will be and prioritise the order in which they will be addressed. That way you have a phased and structured approach to the transformation that is in step with the needs of the business and the capacity of your finance team. We, at Profit&, are here to help you work through all that, delivering and embedding a successful transformation and leaving you with capabilities that you can further evolve over time.

Read on to discover how FP&A process transformation can benefit your organisation and how digital finance technology is redefining the way finance teams now work with their peers, providing them with ultra-fast reports, reforecasts and powerful what-if scenarios, that help them make faster and more insightful responses, to the challenges they face in increasingly challenging markets.

01 Why FP&A process transformation is such a hot topic

There has been a steady stream of disruptions, such as Brexit and the current coronavirus pandemic, in recent years with many suggesting such discontinuities represent a ‘new normal’; a period that the US Army War College suggested has four primary characteristics – Volatility, Uncertainty, Complexity and Ambiguity - or VUCA if you’re a fan of acronyms. It has certainly captured popular imagination in that it sums up everything we have been through in the last few years and are inevitably going to have to face up to in the future, such as the relentless drive to lower costs, rapidly changing demographics, shifting geo-politics and a myriad of game-changing technologies. All of this is presenting businesses with new challenges about how to anticipate, make decisions and constantly course change in this new ‘VUCA’ world.

The expectations of how the finance team would help the business navigate in a ‘VUCA’ world started to change a generation ago, with the professional accounting bodies promoting a vision of the traditional management accountant being transformed into a business partner, responsible for providing senior management with the financial analysis and insight they need to make operational, financial and strategic decisions, to keep the business tightly aligned with changes in their business environment.

However, as yet, few finance teams have made significant progress in transforming their core FP&A processes. This is understandable because until recently there were no planning and budgeting solutions capable of supporting anything other than traditional line-item collection and consolidation. Many are still firefighting with laborious and inflexible legacy systems, or doing workarounds on a plethora of interlinked spreadsheets that compromise productivity, agility and data integrity. Read on and ensure you are better prepared before the next disruption hits.

02 What are the goals of FP&A process transformation?

At its simplest, FP&A transformation focusses on just three issues:

Reducing FP&A cycle times

This means being able to plan and analyse data faster, so you can slash the time it takes to produce a budget and run a reliable reforecast whenever you want to. Doing this means that business users get information quicker and can make a timelier response to variances. However, the ability to expedite cycle times is clearly compromised if finance teams are still constrained with financial systems that process in batch mode and take many hours to calculate. Likewise, the ability to quickly construct new scenarios to explore a range of possible, but as yet uncertain, futures is impossible when working with financial systems with inflexible data structures, that are difficult to amend and typically require data management skills, that need to be requested from an internal IT department or brought in from external contractors.

Providing better decision support to the business

While improving productivity and reducing FP&A cycle times are undoubtedly important, the crux of FP&A transformation is about automating routine, historic reporting cycles to free up time and resource for more value-adding FP&A activities, such as forward-looking scenario modelling that helps business leaders make faster, better-informed and more incisive responses to internal and external changes impacting the business.

An essential building block to providing better decision support is bringing together financial and non-financial data in driver based models that link demand to the resulting operational activities needed to fulfil that demand, to calculate their unit costs to model key variable revenues and line item expenses. At its simplest, it is all about incorporating the calculations that budget contributors already do in the enterprise solutions, but it could easily be a first step towards what many experts call Integrated Business Planning and our partners at Anaplan have labelled Connected Planning.

Clearly the approach lends itself to those large elements of variable expense, such as headcount and other input costs, where keeping tight control on excess capacity falls directly to the bottom line, rather than other line items that are essential fixed or discretionary. It is also more applicable in sectors with a large number of highly repetitive activities such as insurance, consumer packaged goods, hospitality, distribution, professional services and healthcare, each of which has their own characteristic set of drivers. For instance; room rate; occupancy; number of patrons and the average restaurant and bar spend, are all key drivers in the hotel business, and would most likely need to be modelled for each customer segment to accurately reflect the differences between the spending patterns of midweek business folk and those enjoying a weekend family break. But ultimately, there are variable line-item expenses where a driver-based approach can be applied in every budget in every industry.

Improving productivity

Eradicating low-value and time-consuming tasks, such as manually collating data in spreadsheets, so the finance team can do more value-adding work without a commensurate increase is capacity and cost. While many companies have made significant progress in driving down the overall cost of their finance function over the past decade, according to the latest figures published by the American Productivity and Quality Centre, a benchmarking and advisory organisation that has been tracking such metrics for decades, those in the bottom quartile still have costs two and a half times that of the top performers, (1.8% of revenue vs. 0.7% of revenue). These figures show that for many organisations, improving the efficiency of their finance function is still work in progress.

03 What inefficiencies does FP&A process transformation address?

Finance processes are disconnected

All too often executives must wait for updated figures from across the business to be compiled to see the latest financial reports such as profit and loss, balance sheet and cash flow. Financial planning and analysis is a mix of legacy modelling tools including spreadsheets that compile data from so many sources that they have difficulty explaining results. With greater demand for multiple scenarios to be examined in decision making, Finance finds that they are unable to process data quickly enough, so management simply acts on best approximation or even gut feel, rather than hard facts. Digital technology enables reports to be updated dynamically, as data feeds into key financial reports and planning models, direct from the very latest source plans and forecasts.

Disconnected planning and forecasting

Business units operate in silos. They have detailed plans in a combination of legacy systems and spreadsheet models, taking a snapshot of data to model their next set of moves and provide some high-level budget figures back to Finance. The problem is that as individual business units gradually adapt plans to meet changing circumstances, they fall out of step with other departments, resulting in misalignments of capacity and resources that typically manifest themselves as service failures or missed revenue opportunities. Likewise, finance only gets sight of the latest figures when a full, business-wide reforecast is done, which is infrequently due to the time it takes to execute.

Digital technology enables connected plans and forecasts that drive collaboration as exceptions are detected across processes as they happen. Subsequently as everyone develops their own responsibility centre plan and budget using the same upstream forecast, there is better alignment of headcount, other operational resources and fluctuating demand with savings going directly to the bottom line. For instance, if an insurer starts to detect a reduction in the number of mid-term cancellations, then you can be pretty sure that the number of claims will increase in future periods and more resources will be required. The sooner the head of claims knows this, the quicker they can realign capacity and prevent potential service failures. Similarly, if rules are used to identify and alert upcoming capacity constraints, such as the maximum utilisation of seats in the claims contact centre, then timely action can be taken to deal with the situation before it becomes a crisis.

Slow response to market change

There is little doubt that rapid change is becoming the new normal. The most successful businesses can turn on a sixpence when they need to. To have a reasonable understanding of the result of their response, they need real-time information and the ability to quickly model multiple scenarios, considering an ever-increasing number of variables. Finance processes that involve disparate data sources from a combination of legacy systems, feeding multiple modelling tools and spreadsheet models simply cannot meet this need.

The latest digital finance technology enables businesses to be more responsive and agile than ever before. For instance, building driver-based planning models means any changes in demand, selling prices, input costs or any of the drivers involved in the calculations, such as productivity ratios or input costs, can be rapidly updated with the results flowing right through to the forecast profit and loss account and cash flow forecast. This means the organisation can more quickly respond to internal and external changes and planning can become a continuous process, rather than a once or twice yearly event. This gives them greater agility and better visibility into their future financial performance, so they can be more certain of delivering the returns promised to investors and other stakeholders.

04 How does FP&A processes transformation improve decision-making?

Financial Planning and Analysis (FP&A) is a critical finance function in any business. Relied upon to evaluate and mitigate risks, and to provide facts and evidence-based alternatives that help to determine the most financially viable option in any situation. There are several factors that FP&A should focus on to improve decision-making.

Focus on data accuracy

For management information to be trusted and acted upon with confidence, management must understand where the data is sourced and how it is compiled. It must be easy to explain the results or trust will be lost. To ensure accuracy, provide a single source of data for all management information. A single platform that provides a trusted dataset is essential.

Changing the fundamental approach used for planning and budgeting also improves accuracy. Traditional budgeting is open to sandbagging and gaming, but as the assumptions that underpin many line items expenses are transparent in a driver based planning and budgeting model, contributors have to be accountable for their submissions, which in turn are likely to be more accurate. However, be aware that improving the accuracy of financial models by increasing the level of detail at which plans are produced, (e.g. working at the level of individual pack size rather than product category) and by incorporating drivers to produce dynamic models that unify the non-financial and financial domains of the business, requires using additional dimensions and many more line-items. As a result, planning models are considerably more complex and can soon grow to billions of data points. The calculation engines that underpin traditional financial systems were not designed to handle such complexity or volumes, taking many hours to calculate results and needing considerable patience awaiting responses to input changes and queries - as sub second response time is simply out of the question.

Reduce response times

In today’s markets speed of decision making is critical. FP&A must provide real-time insights that give all stakeholders and planners a clear view of the facts surrounding alternative actions. Armed with accurate reliable insights, executives can collaborate constructively and reach a consensus about the most appropriate response quickly.

When traditional budgeting is in use, ascertaining the root cause of any variance usually means making contact with the responsibility centre leader to uncover the operational detail behind the overspend. But where driver-based models are used, the causes behind financial variances are clearly apparent, leading to quicker and more incisive responses. For example, should the cost of claims agents go over budget, it could be that the higher headcount was needed to cope with either lower than forecast productivity or increased throughput. Having that level of operational detail in the model means appropriate action can be taken sooner.

Enable continuous planning and forecasting

This requires plans and forecasts to be dynamic. As a situation changes, fluctuations in demand for example, business unit plans must adjust. If everyone is operating from a common planning platform, a change in one area will cause a ripple effect across to other business units so that appropriate adjustments can be made. This level of continuous planning and forecasting allows business unit managers to collaborate around a common set of data, to discuss alternative responses to significant market events, or emerging trends as they happen, before they have a more damaging impact on the business. And if they can assess trends and make an appropriate response quicker than others in their market, this is undoubtedly a source of competitive advantage.

Provide an end to end process

Connect all plans to key financial reports in real-time, so that actuals and forecasts dynamically update the P&L, cash flow and balance sheet. The Board of Directors have a clear view of the latest and forecasted financial position on-demand, and can make better informed long and short-term strategic decisions about such matters as investment and liquidity.

05 Why is FP&A transformation now easier?

Accounting bodies and other finance gurus have written about the changing role of the finance professional for decades now and no doubt you have answered questions on the topic during your professional exams. But as you will know from experience, it never really happened, with large amounts of resource and time spent battling with inflexible legacy systems and laborious spreadsheets, just to generate month-end reports. However, in recent years, new technologies such as real-time calculation and predictive analytics have meant digital finance has progressed rapidly, resulting in a new generation of solutions with powerful planning, analytic and modelling capabilities, capable of handling large volumes of complex data.

Take cloud-based finance solutions for instance which are quickly becoming a standard for businesses large and small. They provide a common platform and data that effectively democratises planning and analytics, as more people at every level of the organisation can have access, whilst at the same time managing security. But a cloud platform is only part of the story. True digital transformation is a fundamental change in how business units interact.

People, data and plans interact to drive collaboration in business planning and analytics, so that the impact of changes in one business unit is felt and acted upon in others. Business units will no longer plan and execute plans in silos. This results in:

- Universal access to management information and improved collaboration in business planning and how to respond to change.

- A common understanding of business issues and accountability in decision-making.

- Transparency of entire business processes and projected financial outcomes.

- Seamless integration across data platforms for one version of the truth.

- Real-time access to information, proactive decision making and continuous re-forecasting.

This drives an entirely new mind set about business units working together, leveraging planning and analytics to become a more responsive and agile organisation, so they are ready to act as market conditions change. Such capabilities can help business leaders bring about a step change in business performance. However, the right business planning and analysis tools are required to deliver such sort-after capabilities.

06 How Anaplan supports FP&A process transformation.

What is Anaplan?

Standalone spreadsheets, outdated legacy systems - these are the areas in which inefficiencies arise. They don’t provide the proactive, adaptive, value-based solutions that modern finance and business planners need.

The Anaplan platform is the answer. Anaplan provides a cloud-based planning and modelling platform that enables organisations to automate planning, integrate data, and drive dynamic real time updates to a myriad of different types of financial and non-financial processes, across finance, sales, marketing, workforce (HR), and the supply chain. This is despite the fact that they may frequently be working on differing time horizons and at vastly different levels of granularity. Connected planning, as our colleagues at Anaplan label their unique offering, brings together all of these previously separate processes, so users from across the business can collaborate around real-time models that share a single data set, with enterprise levels of access rights and security.

The flexibility of the Anaplan platform means that companies implementing Connected Planning can start by addressing their immediate pain points, before growing their deployment across their business. It could mean starting out with financial planning, then addressing revenue planning before integrating various aspects of sales planning, perhaps by deploying and tailoring Anaplan apps for territory and quota management processes. Alternatively it could be that the most pressing needs are entirely within the finance function and that might mean connecting revenue and expense planning with profit and loss statement forecasting, and then balance sheet and cash flow and capital expenditure forecasting, before growing the deployment out into other business functions.

Think of connected planning as a series of interlinked cells in a honeycomb, each planning model delivering a superior solution for the particular business function, but connected to the next cell to enable data sharing and collaboration. And just like a honeycomb, it’s the cellular structure that gives the overall structure its strength. But it really does not matter where you choose to start; where you go next and at what level of granularity you wish to work at. The intelligent data structure and the ease of modelling in Anaplan means deployments can be rapid and iterative, building a connected planning solution that is uniquely tailored to the needs of your organisation.

So what are the benefits of Anaplan when it comes to finance?

Business planning that is dynamic.

Planning used to be inflexible, split across multiple spreadsheets that were hard to use and even harder to track down. Dynamic planning, on the other hand, is inherently collaborative. It allows for participation, employee buy-in and is a platform that encourages feedback. The right information is at everyone’s fingertips.

Decision-making that is intelligent.

Good data is essential for making good decisions - and good decisions as essential to creating value. The data that Anaplan provides is real-time, meaning it’s the most recent and therefore the most valuable, enabling business leaders to make informed and incisive decisions with full insight of how the choices they make impact financial results.

Not only that, but Anaplan also provides a space to create ‘what-if’ scenarios where you can quickly construct a range of possible futures, explore the implications of your decisions and analyse their potential impact. That way business leaders are better prepared to manage uncertainty and can quickly operationalise any particular scenario as soon as it manifests itself. Scenario planning isn’t a new thing, but Anaplan provides an unrivalled speed when modelling an increasing number of variables and alternative choices quickly and accurately. Instead of reacting within weeks or days, you’ll be rolling out a carefully orchestrated and considered response in hours.

Adaptation that is fast.

Responding in real-time is a key and crucial benefit of the Anaplan business modelling platform. Anaplan also provides a high-level of user experience and accessibility, including a mobile app for decision making on the go. For example, Sonos greatly reduced the amount of time it took to respond to changes in demand. The organisation went from a two-week implementation of change management to an implementation of just one day.

Anaplan is designed for self-management

Business rules that reflect how changing demand impacts resource requirements, revenues and expenses and ultimately financial performance, are the ‘glue’ that makes Connected Planning possible. In the past having to learn even a ‘lightweight’ programming language, such as Microsoft VB Script, deterred many finance departments from embracing driver-based methodologies, but with Anaplan writing business rules could hardly be easier.

Finance – and even authorised business users themselves - can create, maintain and change a model using simple formulas in native syntax and drag-and-drop functionality to express even the most complex multi-dimensional dependencies, without relying on ‘power users’ from IT or outside resources. Once written, these rules are not buried deep inside a model that can rapidly become a ‘black-box’. Using Anaplan’s intuitive Living Blueprint™ technology, all rules are stored and managed in one easy to understand master repository, where non-technical users can view the logic and relationship between the line items in the model, and adjust the business rules that they have the right to access and modify.

Coupled with the benefits of cloud-based delivery, which precludes waiting for hardware or software installations or IT availability. Such easy model management means implementing Anaplan typically takes a fraction of the time of a traditional planning software deployment, giving quick time to value.

Regulations that are met.

There are many capital and liquidity regulations in place and organisations need to be compliant. When data is held in multiple locations that are inherently disconnected, such as legacy systems and spreadsheets, compliance is hard and can be a significant risk to the business. On the other hand, when data is held in one place, such as within the Anaplan platform, business models are secure and auditable. When it comes to compliance having a complete and accurate audit trail is a key benefit of Anaplan.

07 What are the challenges of implementing new technology?

The benefits of digital finance technology are widely recognised. For instance, in an independent survey done in 2017, 41% of Chief Information Officers and IT leaders said their main priority for implementing cloud-based financial technology was to ‘improve the availability and resilience’ of their finance methodologies. The most subscribed point was to ‘improve agility and responsiveness’ – seen as paramount by 39%. However there are several challenges that businesses may have to face when adopting new technology:

1. Ensuring there is a quantifiable Return on Investment (ROI)

Quantifying the ROI of technology is often a challenge. However, it is possible and well worth the effort, as it helps to gain budget approval in the first instance and later to identify opportunities for additional value from your investment. You will be surprised at how reducing the amount of time analysts and other members of the finance team spend manually collating data every month mounts up to give impressive and very tangible ROI that can be quickly realised. For insight into a very pragmatic approach to assessing ROI, see the Forrester report that tracked both the tangible and intangible benefits of a number of Anaplan implementations, that collectively saw an average return in excess of 300% over 3 years. The detailed findings of Forrester’s study are impressive. These are just some of them:

- 50% reduction in data aggregation and forecasting processes, which for one respondent meant savings of 2,700 hours every quarter in the global finance team, worth more than $1.4 million to the organisation over a period of three years.

- Halving the time taken to consolidate and forecast a pipeline for a sales team of 1,000 employees, saving 7,500 hours of manual efforts each quarter.

- Considerably reduced development and update costs, as users were able to maintain their own models, with an average 95% reduction in the amount of outside IT support required, saving one customer over $1.5M annually.

2. Achieving success in reengineering your FP&A processes.

Implementing new technology does not mean your business processes will automatically change as there may be some people in the finance team and across other parts of the business who are ingrained in older, more well-established, ways of working. One way to preclude such resistance is to ensure that users are fully trained and are involved in model design and build, so they quickly come to see the new system as a help, rather than a hindrance.

Equally important is involving teams from finance and the wider business in reviewing and redesigning core FP&A processes, so that you avoid the trap of replicating existing processes to take full advantage of the new technology. In our experience, users quickly enjoy working with Anaplan, soon see the scope for improving the way finance works, and the problem quickly becomes one of prioritising the numerous initiatives for improvement that they identify.

3. Democratise your planning.

It is important to make sure that that new planning processes include all those involved at a variety of levels in the organisation. This makes planning transparent and puts responsibility and accountability for planning into the hands of employees across the business. For example, using Connected Planning software allows you to gather a more granular level of data that enables a better understanding of processes or issues.

When implementing any kind of digital transformation, you need to build a strong knowledge base of the new technology among stakeholders. Providing the means for your staff to upskill makes it more efficient, less time-consuming in the long run, and also means collaboration takes place easily.

4. Prepare your change management.

Implementing new technology means the relationships between departments is likely to change - especially if you’re now benefiting from real-time data and forecasting. Relationship changes have the potential to cause friction. Now, what’s the fix?

The answer is choosing the right implementation partner who will teach your workforce about the technology and shows them the best ways of using it. On top of that, the implementation process needs to be managed from both sides. For example, when Consumer Packaged Goods began using Anaplan, their Senior Finance Director had this to say on the benefits of the technology when it comes to change:

“Anaplan is really an enabler as we added significant process changes… I think Anaplan’s flexibility has allowed us to really build and change the processes quicker than with other systems… I think with Anaplan, its usability and its speed to build allows you to embed those changes quicker.”

08 Real-life examples of FP&A transformation with Anaplan

Now let’s take a brief look at how five companies that were early adopters of connected planning with Anaplan have benefited:

- BT Group — the UK’s largest mobile carrier with 32 million customers — wanted to report revenue in a way that met IFRS 15 standards. However, trying to achieve that using spreadsheets took four management accountants between four and six hours when the company really wanted to release figures the morning after month’s end. By using Anaplan, BT were able to slash process time dramatically, so that now it takes one person less than an hour to calculate their monthly revenue, working with a model that contains more than 30 million lines of data. From that very convincing quick-win, BT grew its connected planning honeycomb to include call center planning, OpEx planning and forecasting and is now exploring ways to connect other types of planning to deliver even greater value.

- Unum, a major US insurer with over 36 million customers, first deployed Anaplan in 2016 to help with financial consolidations. But since realising its capabilities, Anaplan soon became a catalyst for dramatic process change, and its use soon expanded to numerous FP&A processes, including expense budgeting and reporting, and investment portfolio planning and analysis. Since investing in Anaplan, Unum’s finance team is more efficient with expense reporting three times faster than before, with a fortnight’s reduction in the semi-annual budgeting cycle. What’s more, Unum has found that about 80 percent of ad-hoc questions, where business managers formerly required the finance team’s help, are now self-service operations.

- Fruit processor Del Monte used a mix of hundreds of complex spreadsheets and inflexible legacy tools to manage their supply chain processes and its interface with financial planning. The process was slow with simple scenarios taking up to six hours to run. This often resulted in lost sales opportunities and excess inventories. Now using Anaplan, the supply chain and financial planning processes, which previously took two weeks, have been cut to just two days and recalculating the impact of changes in demand now takes less than five minutes, so inventory is much more closely aligned with demand. Since then Del Monte has grown their connected planning honeycomb to report on the profitability of sales channels, SKU’s, or customers so decision-makers are better able to make quick, informed decisions that drive profitability.

- Outdoor apparel brand Helly Hansen recognised that disconnected finance and operational processes sometimes hindered its success. Adopting connected planning using the Anaplan platform allowed the company to reengineer core planning processes, automating routine data collection, slashing planning and budgeting cycles, and connected planning teams across the business. Today the company’s connected planning honeycomb combines financial target-setting, demand forecasting, inventory planning, and other key processes with 50 % less time spent downloading, calculating, and then re-loading budget data.

- ASK Industries, a manufacturer of car audio systems, wanted to replace spreadsheets and develop consistent finance and sales processes, such as investment and sales budgets and P&L and balance sheet creation, across its global businesses. Today the company uses Anaplan for Request for Quotation (RFQ) management, a core process that feeds directly into their sales planning, CapEx planning and forecasting their P&L, balance sheet and cash flow statements. By building and connecting a honeycomb of four models, ASK has improved collaboration, sped up “what-if” analysis, (which now take 10 seconds rather than an entire day), and improved finance’s ability to support a growing and increasingly complex business without adding personnel.

Here at Profit& we have plenty of success stories - a medical products company that has connected its production planning with its P&L, balance sheet and cash flow forecasting; an IT services company that is replacing a myriad of unconnected spreadsheets by connecting Anaplan directly to their CRM so they can re-forecast their long range financial plan on a weekly basis; and a health service provider that is desperate to extend their connected planning honeycomb to include ad hoc scenario modelling, that they recognise would be invaluable during the global coronavirus pandemic.

09 How to choose an Anaplan partner that’s right for you

Choosing the right Anaplan partner to ensure best practice is followed and full potential value is achieved, is a job in itself. An accredited Anaplan Partner will bring experience to your project and help your team to get the most out of your implementation. So what exactly should you look for in your search for an experienced Anaplan partner?

Make sure they are an accredited partner.

Perhaps the most obvious factor to research in a potential partner is their level of experience. If a company is run by experienced consultants, there is a higher likelihood for success than with one run by relative novices. Members of our team at Profit& have been implementing new processes and systems for decades giving us cumulative experience across hundreds of projects spanning a variety of business sectors. Such a wealth of knowledge helps us continually refine best practices and makes certain that even our newer team members can share our tried and tested ways of working.

All of Anaplan’s accredited Silver, Gold or Global partners have demonstrated they are well resourced, have a history of successful implementations and have managed intricate Connected Planning implementations. Profit& is an Anaplan Silver Partner, meaning we’ve delivered consistent, top-quality work, albeit not on a global scale nor across the entire gamut of industries. We have a more selective client base, meaning we can devote more time and focus to your business, developing a deeper understanding of your specific needs and the challenges you are likely to face in the future.

Check they understand your business

The best Anaplan partners will provide a detailed answer when asked how to solve the issues your organisation faces. This answer should cover how they intend to use Anaplan, how it fits your situation and what kind of solutions will be created. These kinds of answers are reinforced by the level of customer service you’re given. The right Anaplan partner will have a team of dedicated specialists ready to help you on your way to connected planning. At Profit&, we’ve helped companies across our territory deliver successful multilingual implementations of the Anaplan platform.

Read their client testimonials

The right Anaplan Partners need compelling testimonials. When searching for a partner, look into what their clients are saying. This will give you a good, external view of the partner and what they’re like to work with. You can explore some of Profit&’s client case studies, such as our work with a UK General Insurer, Grifols and Orkla Foods Norge.10 How Profit& can expedite your FP&A transformation

Here at Profit&, we use Anaplan to implement planning solutions across your business. We analyse the structure of your business, your day-to-day business methodology and create bespoke solutions to begin using in Anaplan. This includes creating a desirable business case to support the creation of stakeholder buy-in.

We start with your needs.

When it comes to FP&A process transformation, typically the pressing need is to replace a legacy planning system and automate laborious processes to expedite cycle times and improve productivity. Sure, we will endeavour to do all that for you. However, we promise we won’t leave you with a ‘vanilla’ solution. Our deep knowledge of the Anaplan platform and our insight of other customers’ successes mean we will endeavour to deliver an innovative solution that provides you with the capabilities you need to thrive in the ‘new normal’. That way you get exactly what’s needed to stay competitive – and we get the job satisfaction that keeps us motivated!

We manage your project the ‘Anaplan Way’.

When it comes to implementation, Anaplan has a number of best practices that only the experts like us can teach. As an accredited Anaplan Partner, we have a deep knowledge of the underlying data architecture, rules engine, and the know-how to quickly build the solution you need using an ‘agile’ methodology that leads to rapid implementation.

We provide a full-service offering.

Our full-service offering covers both helping you envision and plan your FP&A transformation and the very technical know-how involved in implementing Anaplan, providing expertise in data architecture to ensure the Anaplan ecosystem exactly fits into your existing IT landscape. We will also assess the future implications of your implementation giving you a sound foundation for future developments as you expand your implementation across the Anaplan honeycomb.

Look no further - Profit& is here to help.

We will then begin to build your planning ecosystem, all the time looking for quick wins while steadily building capabilities that will result in a compelling ROI. At the same time, we will provide training for your employees, so Anaplan becomes a widely-used and easily accessible platform that you can manage within your finance team.

If you’re interested in starting your Connected Planning journey or even just finding out more information, please contact us. We’ll be happy to answer any of your questions.